Oct 22, 2024 Artificial Intelligence

AI in Banking: How Does AI Reshaping the Financial Services?

Oct 22, 2024 Artificial Intelligence

Table of Contents

Oct 22, 2024 Artificial Intelligence

Wondering how AI in banking sector is transforming financial services? Well, artificial intelligence is globally impacting various industries and Banking is no exception.

The way AI is boldly paving its way into the financial industry is unstoppable. Its buzz in the banking and finance industry is inevitable. The banking advancement is witnessing a groundbreaking transformation, resulting in the excessive demand for AI-based banking development services across the globe.

The integration of AI in the banking sector brings substantial benefits that will not only transform the finance development services but also strengthen competitiveness.

You don’t have to take our word!

Bank of America’s AI chatbot Erica surpassed 1.5 billion interactions since its launch in 2018.

Another example of AI’s prowess in enhancing customer services is Barclay’s use of AI for fraud detection.

“AI doesn’t mean letting go of the human side of our services- instead, we aim to give our customers the convenience of a digital experience with the comfort of a personal touch” said by Group Chief Information officer of Barclays.

With the reports saying that banking institutions are rapidly embracing Artificial Intelligence (AI) and by 2030, AI capabilities will generate approx $1 trillion and cause a 25% reduction in expenses related to operations, compliance, and customer care, it is fair enough to say that AI has a profound impact on banking and financial institutions.

But the question is how AI in banking is changing the landscape and what exactly is transforming traditional banking services?

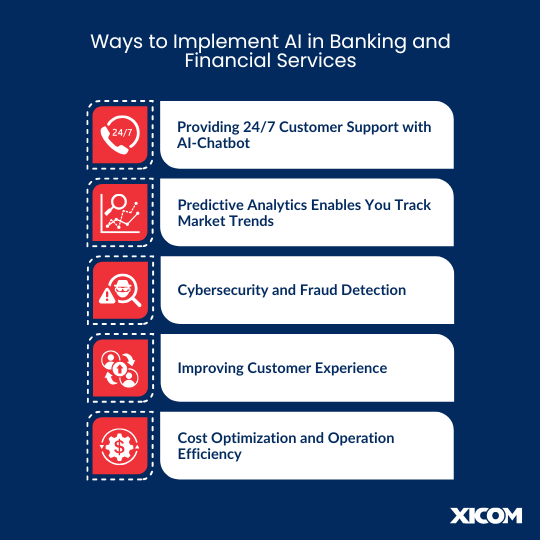

AI is rapidly changing how banks operate, from automating routine tasks to providing advanced analytics for decision-making. Here’s how AI is revolutionizing the banking industry:

Did you know, that 80% of banks are aware of the significant benefits of using AI in banking? If you are all set to revolutionize your banking services by integrating AI capabilities, then hire a mobile app developer with Xicom to take your services to the next level.

Artificial Intelligence has become an integral part of various industries and banking institutions have already started recognizing the transformational impact of AI in financial services.

Here are some major AI applications in the banking industry:

Did you know that 50.5% of the adult population is expected to use AI bank chatbots by the end of 2026?

Is your bank or financial institute ready to deliver an exceptional customer experience with chatbot support? If not, then it’s an alarming time to upgrade your custom banking app by hiring an app developer. It’s only a one-time deployment task that works 24/7, unlike humans with fixed working hours.

Moreover, as Chatbots are working with Machine Learning models that have been trained by professionals before implementation, therefore, after integration, your ML model will keep learning about a particular customer’s usage pattern and be able to better understand the queries.

Here are the quick benefits of incorporating AI chatbots into banking apps:

That’s not all, 55% of businesses that are using chatbots generate more high-quality leads and can save 30% on customer support costs.

Keep your banking services ahead by adopting the latest market trends. Wondering how?

AI and ML integration in FinTech applications can help financial institutions process large-volume data sets gathered from multiple resources. It enables you to scrutinize the data and extract valuable insights into the latest market trends.

But if you are looking to make your mobile app go viral, then it is worth hiring a mobile app development company that helps in creating AI solutions for banks which suggests the best time to invest in stocks and warn when there is risk.

With its high-end data processing capabilities, Predictive Analytics Tools also allow banks to make data-driven decisions and make trading far more convenient for their clients.

There are thousands of digital transactions happening every day via online accounts. As digital transactions are convenient and super fast as compared to traditional transactions.

How do they work and what’s the role of AI in banking to detect fraudulent activities?

By using Generative AI, banks can generate sophisticated risk models that help in predicting economic changes, market movements, and customer behaviors with greater precision.

AI-generated models integrated into mobile app solutions help maintain user’s privacy and data security. The next-gen AI-integrated banking apps are powered by algorithms, so they have the potential to analyze large amounts of transactional-based data, suspect any unusual activity, and more.

Moreover, Artificial Intelligence in Banking apps can help in tracking loopholes in their systems, minimize risks, and improve the overall security of online finance.

Denmark’s largest bank, “Danske Bank” is the biggest example of this which implements a fraud detection algorithm in its business. The integrated deep-learning tool has increased its capability to detect fraud activities by 50% and reduced false activities by 60%.

But if you are looking to decode the average cost to build an AI-integrated app, then you need to book a free consultation slot with our experts!

In the tech-driven era, customers are hopping on banking apps that offer better convenience and experience. For example, check-books are quickly replaced with ATM cards as millennials find it more accessible for depositing and withdrawing money even when banks are not operational.

This level of convenience has inspired banks to bring innovative solutions for their customers. And this is where integrating Artificial Intelligence in banking services will further help in uplifting the customer experience and increase the level of satisfaction.

AI technology can instantly help cut down on the response time of queries, and time taken to record Know Your Customer (KYC) information and eliminate the risk of errors. In addition, it allows banking institutions to launch new products and financial offers exactly when they planned.

Read More: 115+ Top Mobile App Ideas in 2025 For Startups, Entrepreneurs etc.

AI-powered generative systems can optimize banking operations by simply automating back-office tasks such as auditing, reporting, and data reconciliation. This leads to a significant reduction in manual errors, improves process efficiency, and lowers operational costs.

Did you know that businesses are draining 73% of their annual time on manual operations? It ultimately adds up to their overall operational cost which can be easily controlled by simply automating the tasks.

This further gives a chance to banks to discover new insights and increases efficiency!

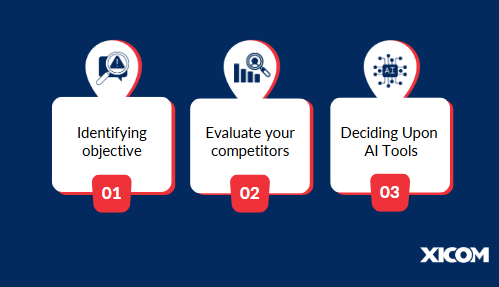

As the banking industry is constantly evolving and embracing digital transformation, adopting an AI-first approach is the way to keep your business ahead in this competitive market. To get started with an app you need to hire an Android app developer, who help you deliver a native app experience and make it available for the majority of smartphone users. Further to make it future-ready with AI capabilities, here’s a step-by-step guide on how banks can get started.

Instead of directly jumping on integrating AI solutions, take a moment to understand your business roadblocks and accordingly define a comprehensive AI strategy that aligns with your goals. To outline your strategy, here you need to pay attention to the key areas:

Before you outsource a mobile app development company, make sure you have a clear AI strategy that aligns with your business vision.

Once you identify what exactly you are trying to achieve with this app, next identify the highest-value AI opportunities that align with the bank’s processes and strategies. Moreover, it is also important to evaluate the need to implement AI banking solutions within their existing or modified operational processes.

Though it’s a critical step, therefore it is worth booking a free consultation slot with AI app developers who deeply validate the use cases with actual market requirements.

The last step in the planning stage is to map out the right AI app development team that can bring your app idea to reality. This is where you can outsource or collaborate with top mobile app development company that understand local market needs.

Choose to work top AI app development company that helps you build a prototype before building a full-fledged app. Next, they develop AI solutions tailored to your specific requirements. This may include machine learning models, natural language processing applications, and automation tools.

Before implementing it in the app store, the experts conduct pilot tests to validate the effectiveness of the AI solutions in real-world scenarios.

Next, gather the feedback, and further scale it up with additional features based on performance and user experience.

Read More: Decoding The Cost To Build An AI-integrated App For Your Business In 2025

There is no doubt in this fact that artificial intelligence is quickly reshaping the banking industry by streamlining banking operations, enhancing customer experience, and overall boosting efficiency. If you are still relying on traditional models for handling banking operations and decision-making, then it is high time to hire a software development company to transform your banking strategies. Xicom’s AI solutions are at the forefront of this transformation that offer advanced practical and innovative solutions that add an edge to your financial services.

If you are all set to revamp your banking services and looking for tailored banking solutions, then drop details below or contact us for the estimations and tailored approach solutions!

Here are some of the FAQs related to AI in banking that help you gather more information and enable you to make informed decisions.

AI is rapidly changing the banking sector by automating routine tasks, providing advanced data analytics, enhancing customer services through chatbots, detecting fraud and false activities with advanced algorithms improving decision-making with predictive analytics, and more. It helps banks to offer personalized financial services that enable them to deliver better customer experience.

Xicom is a leading banking mobile solution development company, specializing in integrating AI technologies into banking processes by offering custom AI solutions tailored to bank’s specific needs. From automating workflows to developing predictive analytics tools, Xicom can help implement AI-driven strategies to optimize operations and improve customer services.

The future of artificial intelligence in banking lies in greater personalization, more advanced fraud detection, and enhanced efficiency through automation. Xicom being at the forefront of customizing banking solutions with AI capabilities can future-proof your banking system by implementing scalable AI solutions and allowing you to stay ahead with updated with the latest trends.

The average cost of banking app development majorly depends upon the decision, whether you are considering integrating AI capabilities into an existing banking app or planning to code it from scratch. Still, if it comes to estimating the average cost, then it can be ranging between $20,000 to $30,000+, depending upon your business requirements.