Nov 12, 2024 Blockchain

Blockchain in Banking: How It Works and Can Be Used in Banking?

Nov 12, 2024 Blockchain

Table of Contents

Nov 12, 2024 Blockchain

Wondering why blockchain in banking is gaining significant attention?

With the reports predicting that blockchain in banking and financial services is expected to grow from $4.61 billion in 2023 to $7.12 billion in 2024 at a CAGR of 54.6%, it is fair enough to say that Blockchain technology has emerged as a strong force in banking.

The global Blockchain market size is projected to reach over $248.9 billion by 2029 and greatly impact all industries, but the banking sector is among the top domains experiencing a digital overhaul through blockchain.

Source: thebusinessresearchcompany

While the technology is well recognized for its leading characteristics of bringing transparency, accuracy, and security, therefore banks are strategically harnessing these features of blockchain in transforming traditional banking systems into blockchain-driven models with enhanced accessibility, efficiency, and security.

The digital inception of blockchain in the fintech industry was recognized with the inception of bitcoins back in 2008 but now Blockchain technology has evolved beyond its original purpose, promising transformative changes in the financial landscape.

But the central question is what exactly made banking systems adapt to blockchain technology and how far is the path simpler to integrate blockchain in banking?

If you are ready to evolve your banking services with blockchain capabilities, then hire a blockchain development company for digital transformation and eliminate the roadblocks. Let’s connect for the estimations and project validation!

If you are also one of those who have been looking at banking institutions, and working with traditional modules, then seriously you are at risk. Emerging technologies are among the biggest threats to banking institutions today.

Banks are the crucial facilitator in an array of economic activities whether it be lending money, trading, transaction settlement, or payment processing. Despite having a stronghold in the market, the fintech industry is still finding it troubling to adapt to the quickly changing landscape of the modern era.

Though 70% of banks have quickly realized this gap and are looking to advance their fintech system, navigating the way the process forward is too slow. Many banking processes remain stuck in paperwork creating inefficiencies that consume 80-90% of time and resources with higher risk rates.

This is where Blockchain technology is gaining momentum as it is known for its decentralized and transparent nature, which is pushing the Financial services industry forward. But the question is “How is Blockchain in Banking changing the industry?”

Blockchain has revolutionized the way the fintech industry is moving. It creates a decentralized, distributed ledger system that allows for secure and transparent transactions between two parties without any need for a middleman. The ledger consists of a series of interconnected blocks each containing a list of transactions.

The best part about using the Blockchain in banking is that once a block is added to the chain, there is no way of altering the transactions. This makes the transactions completely tamper-proof. It also uses cryptography to ensure that only authorized parties can access and validate the transactions.

Now the straight benefits of hiring a mobile app developer to implement Blockchain in Banking is it revolutionizes the way banks operate by enhancing security, increasing efficiency, and reducing operating costs.

Here are the quick highlights of implementing the Blockchain in banking:

In a nutshell, the traditional banking systems are outdated and fintech companies are quickly taking over the competition with their decentralized banking platforms. So to stay competitive, banks look forward to collaborating with companies with blockchain expertise.

Blockchain in banking systems functions as a digital database that securely stores data in cryptographically linked blocks to create an unalterable chain. Each block contains critical information about the transaction such as details of the parties involved in the transaction.

Instead of storing personally identifiable information, blockchain uses digital signatures to maintain privacy and security in the banking system.

Each transaction recorded on the blockchain is distinguished by a unique code known as a “hash.” This hash uniquely classifies each transaction with 100% accuracy, even when two transactions appear identical, such as purchasing the same product twice from the same website.

In that case, each transaction would be assigned a different hash, ensuring data integrity and traceability.

Now the question is how much information blockchain technology can help you store.

Blocks in Blockchain can store up to 1 MB of data, which typically accommodates a few thousand transactions per block. Once a block is filled, it is sealed and linked to the previous block in the chain, creating a secure, sequential, and permanent record of all transactions.

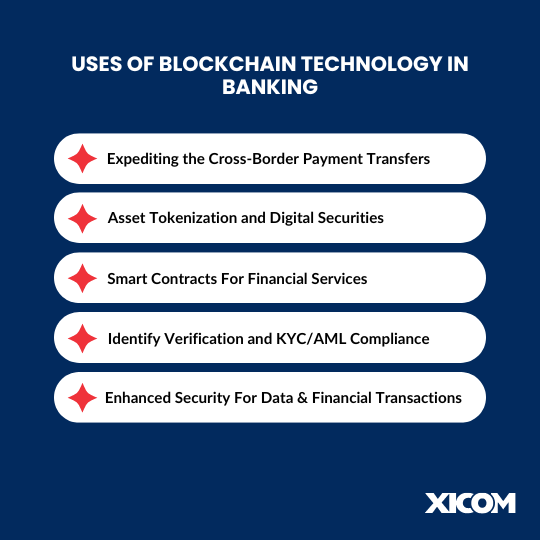

There are multiple use cases of Blockchain in the banking sector, quickly revolutionizing conventional processes and providing enhanced ways to increase efficiency, security, and transparency in financial processes.

If you are still doubting about hiring a software developer and looking to understand the prominent uses of blockchain technology in Banking, then look below:

Did you know for cross-border payment transfers, you and the receiving bank will charge around $25 as flat fees?

And trillions of dollars are annually wasted because of added fees and slow payment processing. By implementing the Blockchain in banking and finance, cross-border transactions can be expedited from days to a few seconds, and eliminate the intermediates.

This is where Blockchain’s ability to facilitate real-time, cross-border payments without intermediaries helps in completing the process in seconds and provides efficient solutions to individual and business users.

Moreover, as the payment happens on a decentralized network, there is no need for transaction verification making the payment transfer faster and cheaper.

Blockchain applications in banking allow physical and digital assets to be converted into digital tokens, which represent ownership in a secure and easily transferable way.

Fintech companies usually use these asset tokenizations to create fractional ownership opportunities in assets like real estate, stocks, or artwork. It helps companies make more feasible investment options and easier trading on digital platforms.

Smart Contracts are programmable agreements that self-execute when are certain conditions met. In the Fintech industry, smart contracts enable automation in services like loan processing, insurance claims, and investment management.

The best part about implementing a Smart contract, it enforces automation without the intervention of intermediaries, reducing processing times and costs.

Still wondering how it will work?

For example, loans can be processed automatically, once credit checks are approved, reducing paperwork, costs, and the need for third-party verification.

Using the Blockchain in the banking system can help you reduce the identity verification process. It simplifies “Know Your Customer (KYC)” and Anti-Money Laundering (AML) processes, by simply storing the customer information on a blockchain.

With this advancement, Fintech companies can reduce redundancy, improve data security, and streamline compliance. All they require is to outsource software development company which allows users to control and share their data securely, minimizing the risk of identity theft.

Blockchain’s cryptographic structure provides a high level of security for sensitive financial data and transactions. As Blockchain is decentralized data is in secure storage, therefore, it’s harder for hackers to alter information.

Implementing the Blockchain in Banking, successfully increases the data security, reducing risks of fraud and data breaches. The security aspect is critical for fintech applications handling personal and financial information.

These are the few ways blockchain in banking can be used, but the question is, how far are the pathways of implementing the blockchain application in banks easier?

The way Blockchain technology is impacting various industries revolutionizing business processes and automating operations, undoubtedly, Blockchain in the banking and financing sector brings many innovations in concern of lowering transaction fees, expediting transaction processing, ensuring better identity verifications, and more.

If you are looking to upgrade the existing banking systems with modern technologies or want to leverage the maximum potential of blockchain for finance, then this would require you to look for companies offering trusted blockchain development services. Make sure, you collaborate with the company that best understands the use cases of Blockchain and is capable enough to pick a multi-faceted approach to integrating this next-gen technology in the banking domain.

Xicom is at the forefront of providing smartly customized Blockchain development services that elevate your digital transformation journey. No matter, whether you are a huge banking institute looking to automate the business process or a budding entrepreneur starting with banking services, our secure blockchain development services are for everyone. By hiring a software developer, you can easily get started with blockchain implementation in the existing system.

Our services range from Smart Contract development, and custom blockchain development to NFT Marketplace development. Book a free slot of consultation to get access to our dedicated team of blockchain developers who specialize in delivering impeccable blockchain solutions.

Read More: 115+ Top Mobile App Ideas in 2025 For Startups, Entrepreneurs etc.

At the end of this blog, it is fair enough to mention that the way blockchain technology is paving its way into various industries, is the future of modern banking infrastructure. If you are still relying on those old-tiered systems, then it is high time for banking and financial institutions to realize the transformative potential of blockchain technology and make the most of the opportunity to become early adopters.

If you are also looking to revamp your banking operations or automate the process by leveraging the blockchain features, then hire a mobile app development company. Xicom is one such leading companies strive to offer advanced blockchain development services that are secure and responsible.

So if you are considering making a careful investment in a blockchain app for banking and financial institutes, then drop your details or contact us directly for the estimations.

Here we have gathered additional information related to implementing the blockchain into the banking sector and help you understand the services in a better way.

Blockchain is a decentralized digital ledger that records transactions securely and transparently. In banking, blockchain technology is rapidly revolutionizing the way banks transfer funds, keep data records, and improve security. Blockchain in banking helps to store transaction data in blocks, each uniquely linked to the previous block, creating an immutable chain. Its structure enhances data security, reduces fraud, and streamlines financial transactions.

Blockchain can benefit banks in various ways by reducing operational costs, saving cross-border payment transfer fees, improving processing speeds, enhancing security, and automating processes through smart contracts.

Being a leading Blockchain development company, we provide a wide range of Blockchain app development services including DeFi solutions, Asset Tokenization, smart contract development, Blockchain-based payments, and more.

Leveraging 20+ years of expertise in modernizing legacy solutions, our team can seamlessly help you integrate Blockchain technology into the existing banking system by carefully analyzing the compatibility requirements and accordingly providing the expected timeline for implementation.

The cost of blockchain development services is majorly dependent upon the complexity of requirements, ongoing development time, resources required for app development, and any maintenance or support required after the launch. The rough estimation of blockchain app development services will revolve around $20,000 to $50,000+, depending upon your requirements.