Dec 5, 2024 Blockchain

Blockchain in Trade Finance – How it is Revolutionizing the Finance Industry

Dec 5, 2024 Blockchain

Table of Contents

Dec 5, 2024 Blockchain

Why is integrating blockchain in trade finance taking the central stage?

Well, the stats and the big picture of the finance industry contradict each other and leave people in dilemmas. Here’s how!

According to the reports, the financial services market is expected to grow from $25,848 billion in 2022 to $37,484 billion by 2027!

The global investment activity in Fintech companies is expected to reach $113.7 billion.

The pace at which the financial industry is growing is impressive and has comprises one of the most important and influential sectors of the economy.

On the other hand, if looking at the big picture, a few long-standing challenges, such as slow transactions, fraud risks, complex cross-border payment systems, and more, are holding back the market growth.

With traditional methods, transactions always remain complex and inefficient. It requires transparency, data security, and efficient solutions that enable businesses to conduct more seamless transactions.

This is where Blockchain in the trade finance industry turns out to be a game changer!

Blockchain is quickly transforming commerce by digitizing trust and enabling real-time, tamperproof, decentralized transactions. By eliminating intermediaries, Blockchain reduces operational costs, speeds up processes, and enhances security.

That’s not all!

From digitizing letters to credit to automating payment settlements, blockchain technology is deeply reshaping how global trade operates.

Looking to embrace blockchain in trade finance? Xicom enables you to hire a mobile app developer to strategically optimize your trade finance processes enhance security and drive efficiency. Let’s connect for further details!

Still, doubting whether to invest in blockchain technology to revamp your financial process? If yes, then here are the market stats at a glance…

Using blockchain technology in banking and trade finance is a hot topic these days. Expert says that the blockchain market in banking and financial services could hit around $27.69 billion by 2028. This bloom is largely trigged by the Blockchain’s ability to save time and cost on each transaction.

Source: thebusinessresearchcompany

Blockchain has eliminated the middleman in transactions which ultimately means lower costs and faster processing times, which is great news for everyone.

You must be surprised to recognize this huge growth in the banking sector. But if you notice, just think about the reason why blockchain technology is required and what are the potential challenges that have been reshaped by implementing blockchain in trade finance.

The global trade finance landscape is heavily reliant on centralized systems and manual processes, which in turn causes several challenges, especially in developing countries.

Here’s how these issues intersect with economic difficulties:

Trading and financing generate vast amounts of unstructured data. Bills, invoices, and compliance records are often stored in complicated formats which makes data extraction and analysis highly challenging for businesses.

For developing countries, where digital infrastructure is limited, this inefficiency causes delays in trade processes, increases costs, and hinders their ability to compete globally.

Did you know that trade finance contributes to 15.2% of total data moving globally?

Trade finance involves the exchange of an overwhelming volume of documents that requires deep verification, validation, and compliance checks.

With the traditional centralized systems, manual handling of such documents leads to significant delays, errors, and transaction backlogs.

These inefficiencies hinder the ability of developing economies to participate in global trade effectively.

Stringent Compliance regulations such as Anti-money laundering and know-your-customers (KYC) requirements, demand meticulous documentation and analysis.

Developing countries often lack the technological infrastructure to perform compliance checks efficiently. This results in trade delays increased transaction costs and economic competitiveness. But this is where hiring a software developer is a worthy decision

The reliance on manual processes in traditional systems not only increases the probability of errors but also leads to trust issues in trade finance systems.

The lack of decentralization in developing countries often faces amplified challenges due to limited resources, which ultimately hinders transparency in the financial process and affects the credibility of international trade.

Here are the few direct impacts on businesses caused by the lack of blockchain in trade finance:

This is where to overcome these challenges, hiring a Blockchain development company to adopt blockchain in trade finance solutions powered by a decentralized system is the simple way for businesses to achieve a more equitable position in global trade.

Trade finance has been long burdened by inefficiencies. All those paper-based documentation, manual processes, and reliance on intermediaries slow down transactions, increase costs, and lead risk of fraud.

However, a new era powered by blockchain technology can offer a secure, transparent, and immutable ledger system that can revolutionize trade finance.

Here’s how its benefits:

The implementation of blockchain in trade finance can enhance transparency as all participants have a real-time view of the transaction status on the blockchain.

Blockchain technology makes it possible for businesses to record multiple transaction details in sync with the business agreements. When placed in a decentralized network, it becomes possible to share data between the participants.

This practice ultimately fosters trust and reduces the risk of errors or discrepancies. With Blockchain, you don’t have to chase for paperwork or wait for confirmations.

Smarter Contracts are self-executing agreements coded onto the blockchain, automated key steps in the trade finance process. When predetermined conditions are met in the smarter contracts, the payments are automatically released. This eliminated human error and streamlined the flow of funds.

Another way of automating the payment process is using AI. There are various examples of using AI in stock trading and how it is redefining the financial markets.

With the integration of blockchain in trade finance, small to medium-sized enterprises often struggle to access traditional trade finance solutions. Blockchain can level the playing field by offering a more inclusive and transparent system.

Blockchain technology has the potential to revamp trade finance by enhancing transparency, efficiency, and security in various processes. Before you head straight to look forward for outsourcing software development company, it is important to understand how Blockchain in trade finance works and is being used practically:

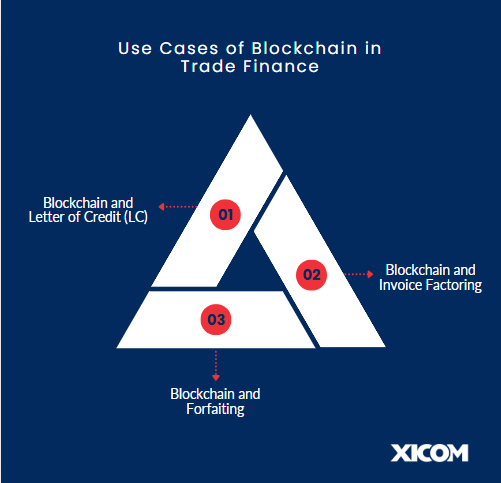

The major challenge aligned with traditional Letter to Credit is it is slower, paper-intensive, and prone to fraud and errors as it majorly relies upon manual work.

In trade finance, this is one of the crucial aspects that can be easily revived by implementing Blockchain. But how is Blockchain used in LC?

Here’s how:

Trade finance invoices are a huge amount of invoices that are available in unstructured formats. Invoice factoring involves manual document verification which leads to blurry transparency.

Factoring such invoices causes delays and requires higher operation costs. So that’s where Blockchain integration can automate the release of funds upon invoice approval and improve cash flow.

Blockchain enables secure, real-time sharing of invoice data between businesses, financiers, and buyers. Further, by hiring a Blockchain developer with Xicom, you can easily shrink the fraud risk such as double financing.

The next application of Blockchain technology and trade finance can be seen in Forfaiting. These processes involve high transaction costs and risk due to the limited transparency in debt instruments.

However, blockchain helps in creating a digital ledger for debt instruments, ensuring traceability and authenticity.

Further, the payment process can be automated using smart contracts and simplify the payment collection and settlement processes reducing the need for intermediaries.

A real-world application of banks using the blockchain for trade finance is HSBC and Bank of Communications.

In a nutshell, there are endless opportunities for using blockchain capabilities to refine trade finance. However, the outcomes always depend upon the choice of professionals you collaborate with for the transformation.

Incorporating blockchain into trade finance systems can be a game-changer for businesses. However, to leverage the full potential of blockchain in trade finance, you need to hire an app developer who understands the complexities of your business requirements.

This is where Xicom offers you an end-to-end tailored solution to help organizations seamlessly adopt blockchain technology and revamp the payment process.

Here’s how Xicom Can assist in adopting blockchain in trade finance:

No matter how complex your trade finance app development requirements are, our dedicated blockchain app developers can easily handle it. For detailed project analysis, we recommend you book a free consultation slot with our experts. They will analyze the requirements, and provide detailed solutions, estimations, and timelines as per your project requirements.

Read More: Understand How to Build a Trading App Like Robinhood using Blockchain Capabilities.

By the end of this blog, Blockchain technology will continue gaining momentum and reshaping industries. Implementing the blockchain in trade finance can enhance transparency, efficiency, and security throughout the transactional process. Its immutable ledger ensures trust among parties and reduces the risk of fraud. However, integrating the blockchain into trade finance has its challenges. This is where hiring a mobile app development company will be a worthy decision to leverage this transformative technology for your business.

At Xicom, we specialize in developing cutting-edge blockchain trade finance solutions, from mobile apps to web applications. Backed by an experienced team, we can seamlessly help you harness the power of blockchain to optimize your trade finance processes, enhance security, and drive efficiency.

So if you are ready to turn your ideas into reality and revolutionize your trade finance operations with blockchain technology, then drop a query below or contact us for detailed estimations!

Here we have gathered detailed information related to blockchain in trade finance and how it can help you upgrade your business operations.

Blockchain is a decentralized ledger technology that records transactions securely and transparently. In trade finance, blockchain implementation facilitates processes such as document verification, payment settlement compliance checks, and more.

The major benefits of using blockchain in trade finance are it enhances transparency and security, faster transactions by automating document handling, reduces fraud through systematic records, and improves efficiency by eliminating intermediaries.

Xicom, being a specialized Blockchain app development company offers end-to-end solutions, including strategy development, implementation, and post-deployment support, to transform your trade finance processes.

Yes, we enable you to hire blockchain app developers ensuring seamless integration of blockchain with your current infrastructure. Our team will deeply analyze your existing challenges with the current system, develop a strategic roadmap, and accordingly find the scope of transforming the system with Blockchain.

The average cost to implement Blockchain in trade finance usually ranges between $20,000 to $30,000+ but it can greatly vary based on the complexity of project requirements, the hourly cost of the blockchain developers, and more. Therefore, we always recommend you book a free consultation slot with our experts to get a real estimation based on your project requirements.