Jul 18, 2024 App Development

How to Build a Trading App Like Robinhood?

Jul 18, 2024 App Development

Table of Contents

Jul 18, 2024 App Development

How to build a trading app like Robinhood? This is the first question that pops up in your mind if you have newly started trading and have been attracted to its workflow.

Well, Robinhood is one of the renowned yet trusted stock trading apps that is backed by 23.9 million funded customers with 13.7 million monthly active users, and $130 billion in assets under custody.

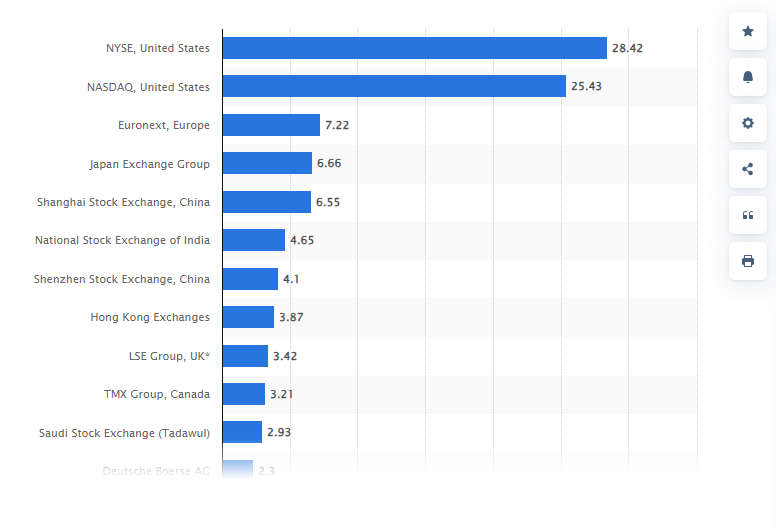

With the predictions that the New York Stock Exchange (NYSE) will remain the largest stock exchange in the world with an equity market capitalization of over $28 trillion in 2024, the demand for Stock trading app development has suddenly touched the sky.

Image Source: Statista

Owning a startup in the fintech industry and choosing to build a traditing app like Robinhood would be a billion-dollar business idea. With millions of active users and handling trillions of transactions every month, Robinhood sets itself as a perfect example for inspiration.

But the centeral question is how to build a trading app like Robinhood from scratch.

Well, look no further! In this blog post, we will guide you through the steps and principles involved in creating a trading app similar to Robinhood.

A trading app has the potential to revolutionize the world of investments, providing users with a simple and convenient platform to trade stocks, cryptocurrencies, and other financial assets.

These platforms are already paving their way and becoming the primary source of investment for millennials. Don’t be surprised!

How many of you are visiting the back today to open fixed deposits? And how many youngsters do you see at the bank in today’s modern era?

Even some percentage of oldies are switching to these trading platforms as they find it a more convenient, engaging, and thrilling option for investments.

Though creating a stock trading app seems to be an interesting business opportunity for startups creating a successful trading app goes beyond just attractive interfaces and sleek designs. It necessitates extensive market research, a deep understanding of crucial features, adherence to regulatory requirements, and a dependable development team.

In this detailed guide, we will take you step by step through the process of creating a trading app similar to Robinhood. We’ll start with market research and selecting the appropriate technology stack. Furthermore, we’ll delve into examining cost estimates, implementing security measures, and emphasizing the significance of a user-friendly interface.

Are you eager to transform your idea into a tangible reality and develop a trading app to become a part of the $28 trillion market size? If yes, then it’s time to collaborate with a top mobile app development company.

Robinhood has completely changed the investment industry with its easy-to-use interface and smooth trading experience. If you’re considering to build a trading app like Robinhood, this comprehensive guide will take you through every step of the development process.

To understand why Robinhood has been so successful, it’s important to identify its key features.

The primary target audience of Robinhood is millennials and first-time investors who seek a user-friendly and efficient platform for stock trading. These users prioritize simplicity, affordability, and accessibility.

Conducting market research is a crucial initial action when creating a trading app like Robinhood. By analyzing the market, you can identify trends, evaluate competition, and gauge the demand for your app. It’s important to have an in-depth understanding of your target audience’s needs and obstacles, as this will inform the features and functionalities you incorporate into your app.

Before diving into app development, it’s crucial to gather market insights through thorough research. This will help you make informed decisions about your app’s development approach. You’ll need to determine whether a native app for iOS and Android is the right fit or if a progressive web app accessible across multiple platforms through a web browser would better suit your needs. Consider the advantages and disadvantages of each approach, carefully assessing which one aligns best with your business goals and target audience.

The success of any trading app is heavily dependent on user experience (UX). It’s important to design an interface that is intuitive and user-friendly, making it easy for users to navigate and execute trades effortlessly. Prioritize creating a visually appealing and responsive design that ensures a seamless and engaging trading experience.

To ensure a seamless and prosperous app development journey, it is crucial to collaborate with a dependable and seasoned software development company. Seek out a team that possesses expertise in fintech and trading app development. They will assist you in navigating the complexities of incorporating trading functionalities, integrating APIs for real-time market data, and ensuring compliance with financial regulations.

To ensure a seamless user experience, it is vital to thoroughly test your app for any bugs or usability issues prior to launching. This testing phase should encompass various devices, operating systems, and network conditions. Once the testing process is finished, you can proceed with deploying your app on the Google Play Store for Android users and the Apple App Store for iOS users.

Features and functionalities of the trading app are the major success driving factors but it can quickly add up to the overall budget. So be careful and before you jump into app development, make sure you prioritize the features for the MVP and then switch to a full-fledged app version.

Let’s check out the feature you can consider integrating at the basic level:

Having a smooth and hassle-free user registration process is essential for attracting new users. By offering simplified and secure sign-up options, like using email addresses or phone numbers, you can greatly enhance the overall user experience.

By allowing users to link their bank accounts or credit cards to the app, it becomes convenient for them to make deposits and withdrawals. This could be a little challenging, so it is worth hiring a mobile app developer to integrate secure payment gateways and help build trust among users.

By integrating popular payment options such as PayPal or Google Pay, you can cater to users who prefer these platforms for their financial transactions.

By incorporating advanced data analytics functionalities, users can access valuable market data, charts, and indicators that provide valuable insights for making informed decisions.

By providing a carefully selected news feed that offers real-time updates on market trends, stock news, and company announcements, users can stay informed and engaged.

Offering reliable customer support options like live chat or dedicated helplines allows users to easily seek assistance whenever they need it.

Whether you are a startup or a leading entrepreneur, making a profit from your trading app like Robinhood will be the ultimate goal of your app development decision. Well, you can implement various revenue models apart from traditional commission fees by simply choosing to hire Android app developer. But here we will unlock some of the top ways of making revenue from the trading app like Robinhood:

One of the top revenue generation strategies for Robinhood-like trading apps is the Payment for Order Flow model. In this model, trading applications sell their users’ trade orders to market makers. These market makers pay the brokerage for the order flow, execute the trades, and earn through small spreads on the bid and ask prices of the traded securities. While each transaction yields a small amount, the volume of transactions can lead to significant revenue.

Offer premium services or subscription plans to your users. These can include advanced investment tools, detailed research reports, real-time market data, investment tips, and margin trading opportunities at lower interest rates. Charging monthly or annual fees for these enhanced features can provide a steady revenue stream.

Provide margin loans and lend securities to counterparties. You can charge substantial interest rates on margin loans, especially for amounts above $1,000. This interest on borrowed funds can become a major source of revenue.

Utilize the funds that users keep in their accounts by depositing them in savings banks. The interest earned on these deposits can contribute to your revenues. While this amount might be smaller compared to other revenue models, it still adds up over time.

Partnerships and Sponsorships: Partner with other financial services, broker firms, or companies and charge commissions for user referrals.

By diversifying your revenue streams and leveraging these models, you can effectively monetize your trading app like Robinhood, ensuring profitability and sustainability in the competitive fintech market.

To determine the cost of developing a trading app like Robinhood, we must first analyze and examine each individual component involved in the development process.

In total, the cost of developing a trading app like Robinhood can often exceed $1 million. However, this is only an estimate, as the final cost will depend on various factors such as the project’s size, scope, desired features, and the chosen development team. One thing is certain though – creating a trading app is a substantial endeavor that demands considerable investment in terms of time, money, and resources to ensure its success.

If you want to build a robust trading platform, it’s important to approach the task with careful planning and attention to detail. Here are some essential tips for your consideration:

Start by conducting a comprehensive analysis of existing trading platforms. It’s crucial to identify their strengths, weaknesses, and unique selling points. This knowledge will serve as a foundation for creating a standout platform that distinguishes itself from the competition.

Complying with financial regulations is crucial for the success and credibility of your trading platform. It is important to familiarize yourself with regulatory frameworks, including the Consumer Financial Protection Bureau and anti-money laundering guidelines, to ensure that your platform meets all necessary regulations.

When creating your trading platform, it’s important to determine the key features that are essential for your target audience. This is where you can look forward to hire React Native app developer that can help prioritize your features for multiple platform.

Here are some important features to consider:

In order to successfully launch a trading app, it is crucial to create a well-rounded marketing strategy. This involves emphasizing the distinctive features of your app, such as commission-free trading, an intuitive user interface, or any additional offerings. It is important to consider various promotional activities, tailored advertising campaigns, as well as collaborations with influential figures in the financial sector.

When selecting a business model, it’s crucial to consider various factors. One notable example is Robinhood, which utilizes a combination of revenue streams. These include premium subscription plans, interest earnings from users’ cash holdings, and payments generated from order flow.

Ensuring legal compliance and building trust are essential for financial institutions. Compliance with regulations such as anti-money laundering (AML) and know-your-customer (KYC) requirements is crucial in this regard. Following the guidelines set by regulatory bodies like the Consumer Financial Protection Bureau and the Securities and Exchange Commission is vital to protect user interests.

Read More: 115+ Top Mobile App Ideas in 2025 For Startups, Entrepreneurs etc.

Investing in stock trading apps is a serious decision for startups as well as entrepreneurs. While this domain is already led by Robinhood-like trading apps, therefore, you need to be strategic here and follow the steps that enable you to lead the process in the right direction.

A well-planned and developed trading app can be a game changer for your banking and financial business. Therefore, it is important to hire a software developer with the right experience, expertise, and skills.

Xicom Technologies can help you build a stock trading app that provides expertise, resources, and a structured development process. We are backed by 100+ dedicated fintech professionals who assist business owners in building and launching a seamless trading app.

Here’s how we can assure you a brilliant stock trading app:

Building an app like Robinhood requires a great deal of dedication, persistence, and innovative thinking, as our blog post has highlighted. It’s important to remember that creating an app involves more than just the technical aspects of coding and development. It also requires delivering a seamless experience for your users. While building a trading app like Robinhood may present its challenges, with the right resources and proper planning, you can turn this vision into a reality.

We believe that our insights have equipped you with the necessary confidence and knowledge to embark on the exciting journey of creating your very own trading app. But choosing to hire a mobile application development company can help you harness the power of innovative technologies, gaining a thorough understanding of your target audience, and continuously testing and refining your app, you are sure to make waves in the finance industry with your groundbreaking creation.

So take a leap of faith, think innovatively, and create an app that not just disrupts the game but transforms it entirely. The trading world eagerly anticipates your app, and we’re excited to witness the brilliance you unleash.

The timeline for developing a trading app can vary based on the complexity and specific requirements. On average, it typically takes between 4 to 12 months to complete the development process.

The cost of developing a trading app can vary greatly depending on several factors, including the scope of the project, required features, chosen technology stack, and rates charged by the development team. Generally, building a trading app can range from tens of thousands to hundreds of thousands of dollars.

It is highly recommended to provide users with real-time stock data in order to keep them informed with up-to-date information. By integrating reliable data providers or financial services APIs, you can ensure that your platform offers accurate and timely stock market information.